Reacting to market news

Threats to business turnover and profits for OKOMUOIL

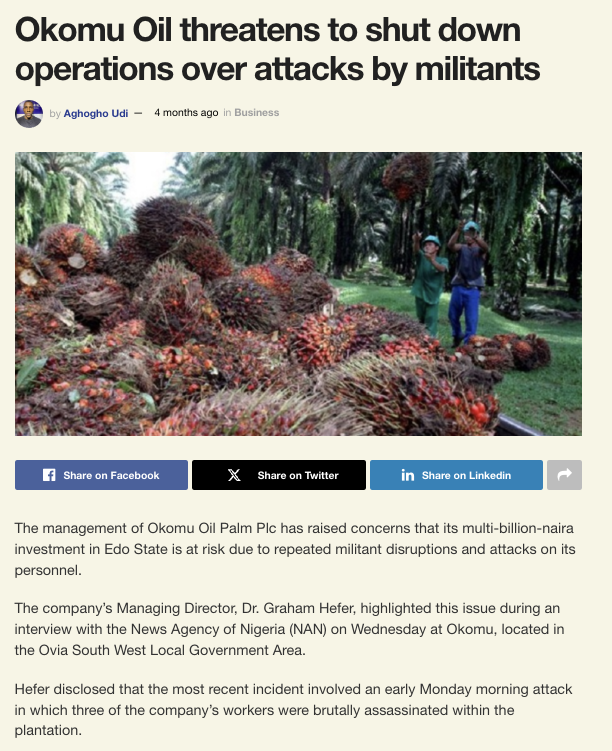

Yesterday, I saw an X post about a predicted 68% drop in profits for Okomu Oil as bandits attack and destroy their facilities. It was off the back of earlier news (that I was vaguely aware of) that said bandits requested, as ransom, 20% of Okomu Oil unless they'd attack their facilities like they're doing now.

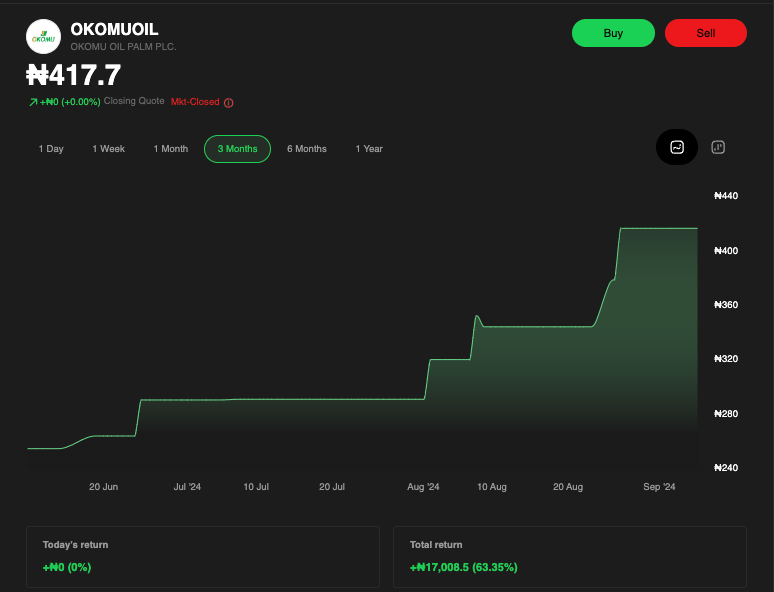

I immediately took stock of how much exposure I had. I had 105 units that cost about NGN 28k (65@279.8, 40@232.5). Current value is about NGN 43k (105@417.7). That's 63.35% in capital appreciation.

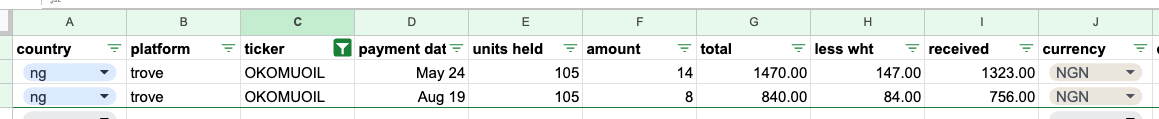

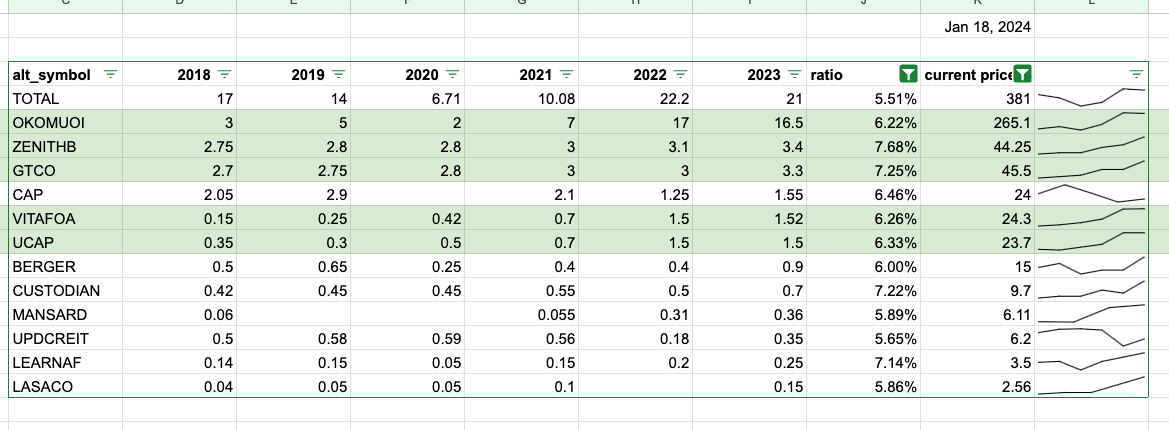

Sounds really good, but I bought in for the dividends. And since my first purchase (Jan 31), I have received dividends twice, a total of NGN 2,079. That's a 7.4% return on my cost. It matches my expected returns.

My target was to leave these investments for 3 years, and conduct re-evaluation every year. But these are extenuating circumstances.

My reasoning

This is no longer a threat. The company has projected a decline in its annual turn over and bottomline profits. This has cause to impact payable dividends.

I was going to opt for no-reaction at all, but what does that teach me about being attentive to market news just as much as fundamentals. I also briefly thought about the reaction of other investors. The Nigerian stock market is infamous for not responding to news; but you can't be certain, can you? Not until the market opens.

Ultimately, I decided to not be reactionary, at least not because other investors are doing it. I have reason to believe that the projected decline, if it materialises and continues, will not only affect my dividend returns but also cause me to lose my capital.

So, my action

Sell off just enough to make back your capital.

Invest it in a mutual fund. Safekeeping for a reinvestment in OKOMUOIL should the company find a way to address the problem and return to normal business.

There you have it.