Stock Investment Evaluation for 2024

Written earlier in Jan 2024, published for public use.

21.02.24; 0937

It’s already January 2024, and I am yet to make the moves I was supposed to.

Let’s start from the Nigerian market.

Nigerian stocks

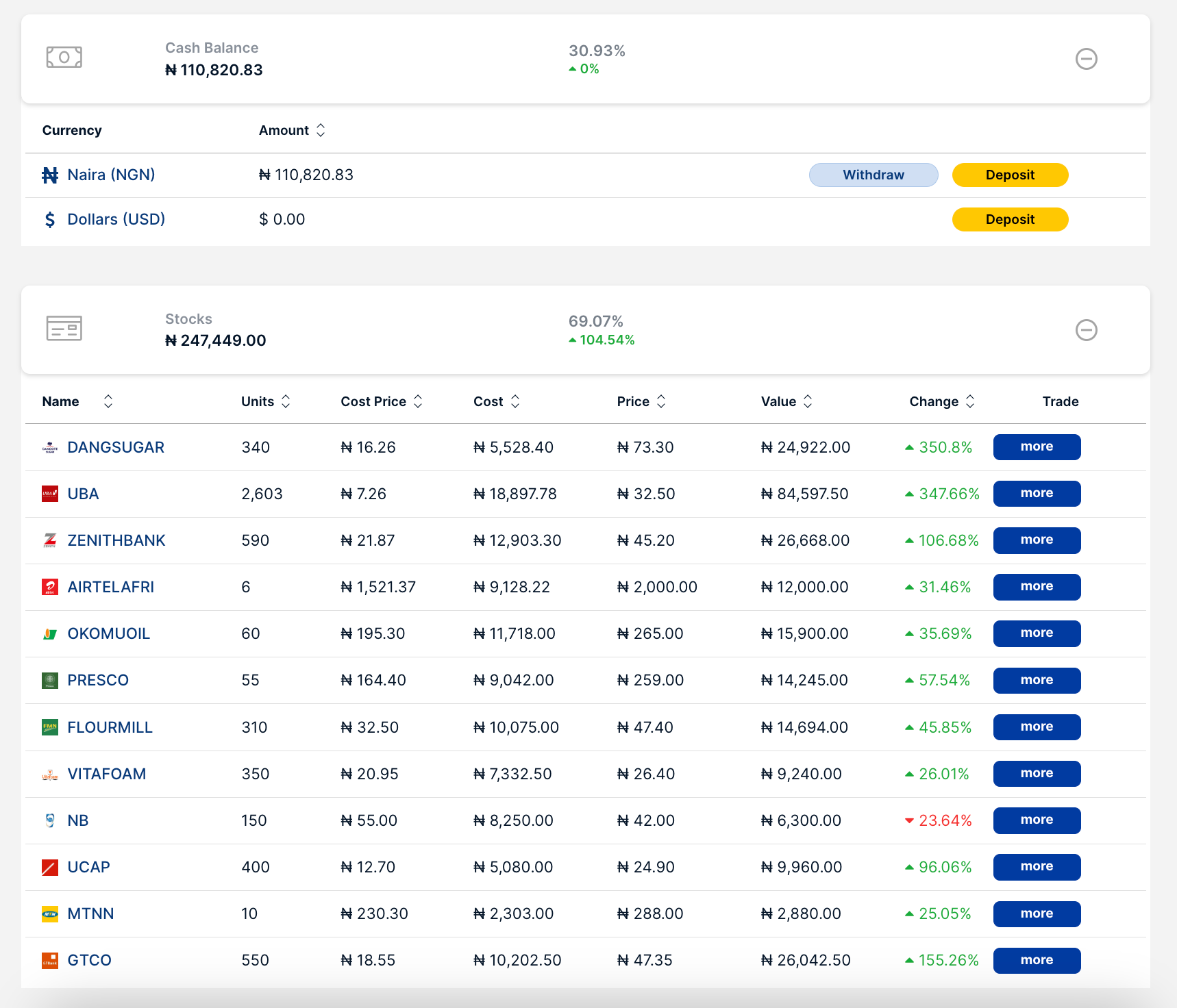

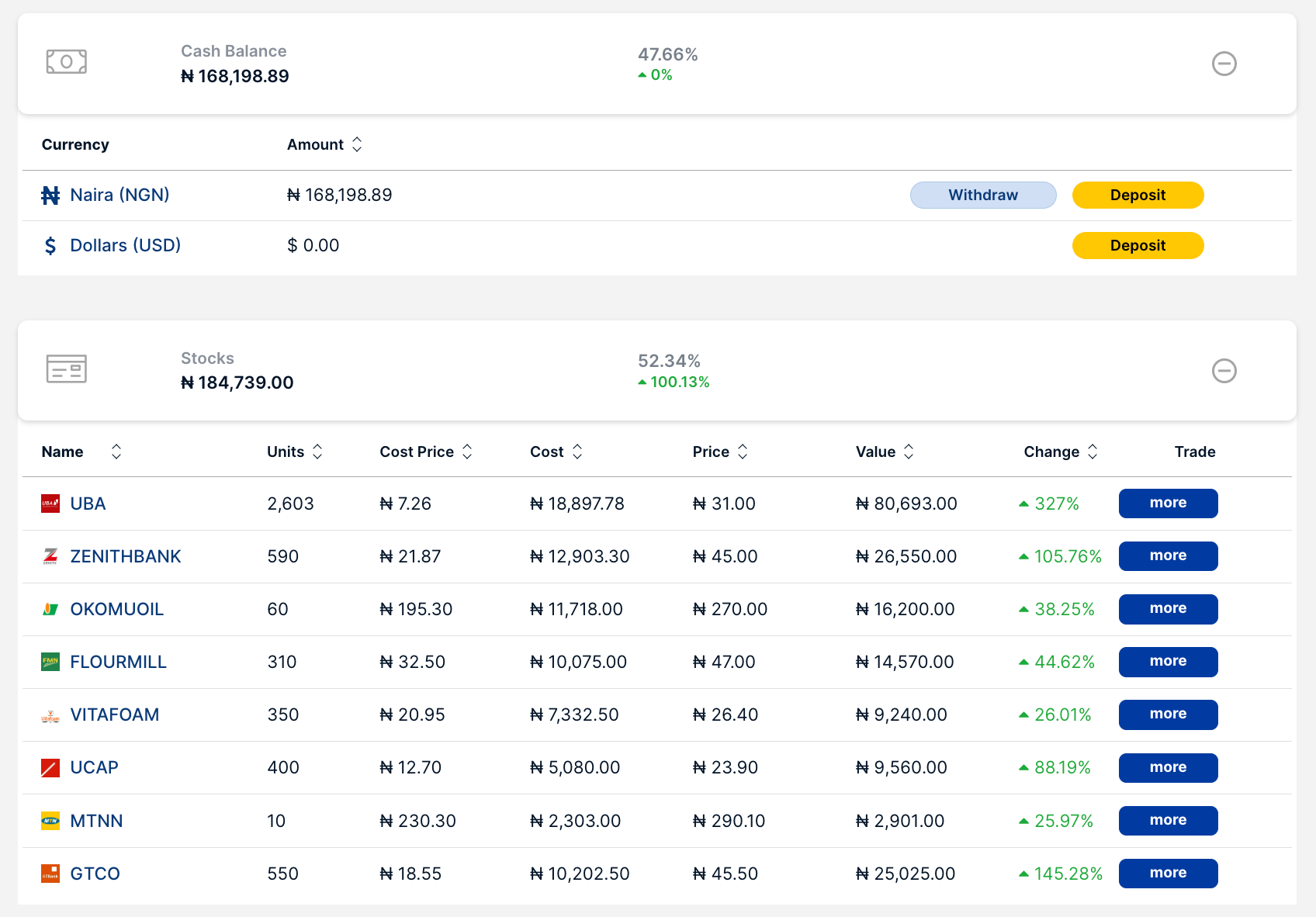

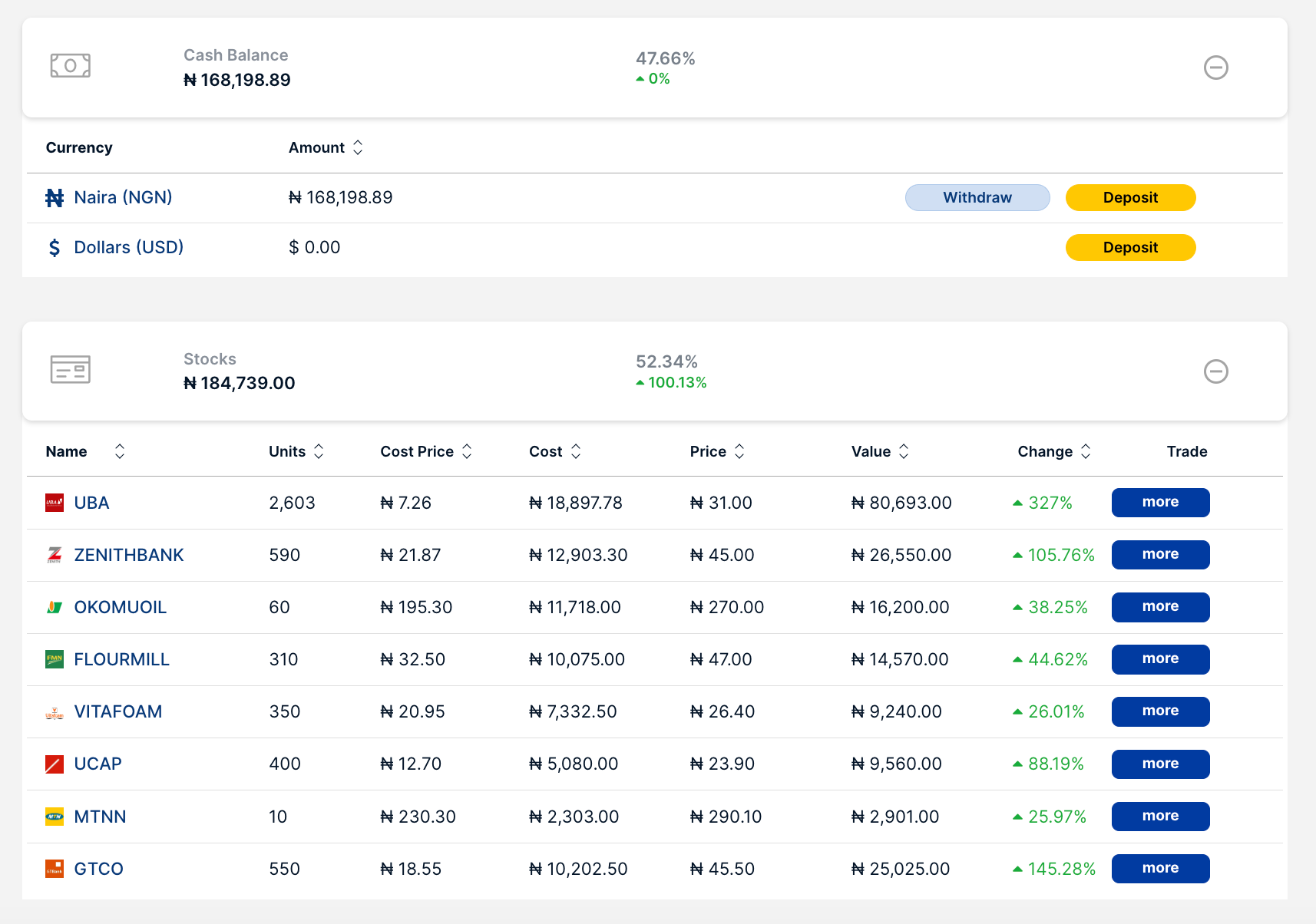

As of Jan 18, this was my portfolio.

My goal was to shed the stocks with lower dividends and concentrate on those with higher dividends. My task was to determine which had the highest dividends.

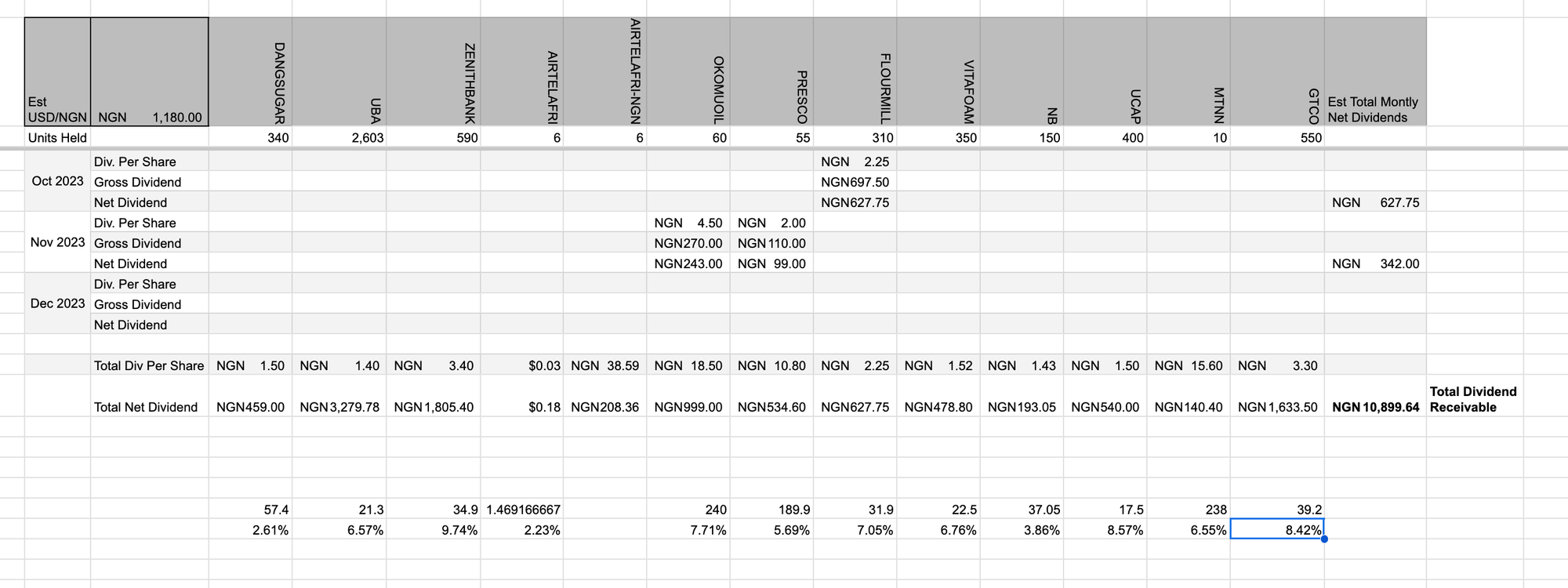

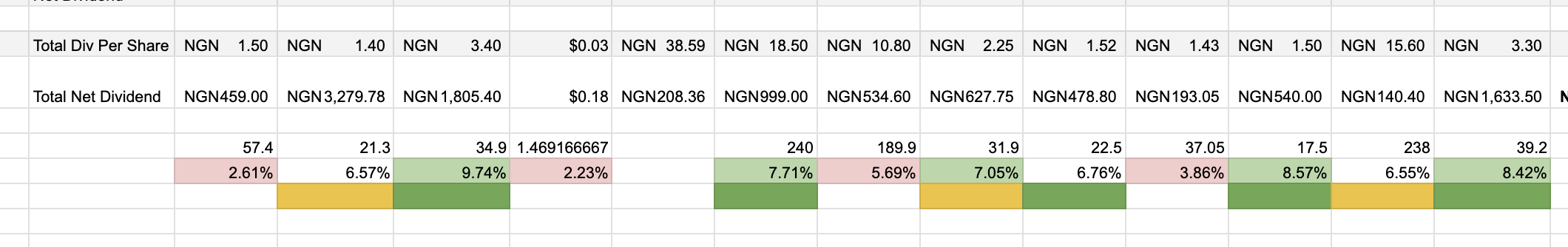

I analysed the stocks I had and came up with this.

Now, it showed some promising stocks that I had, but I did not know if other stocks I did not buy would perform better so I had to analyse all the stocks on the market.

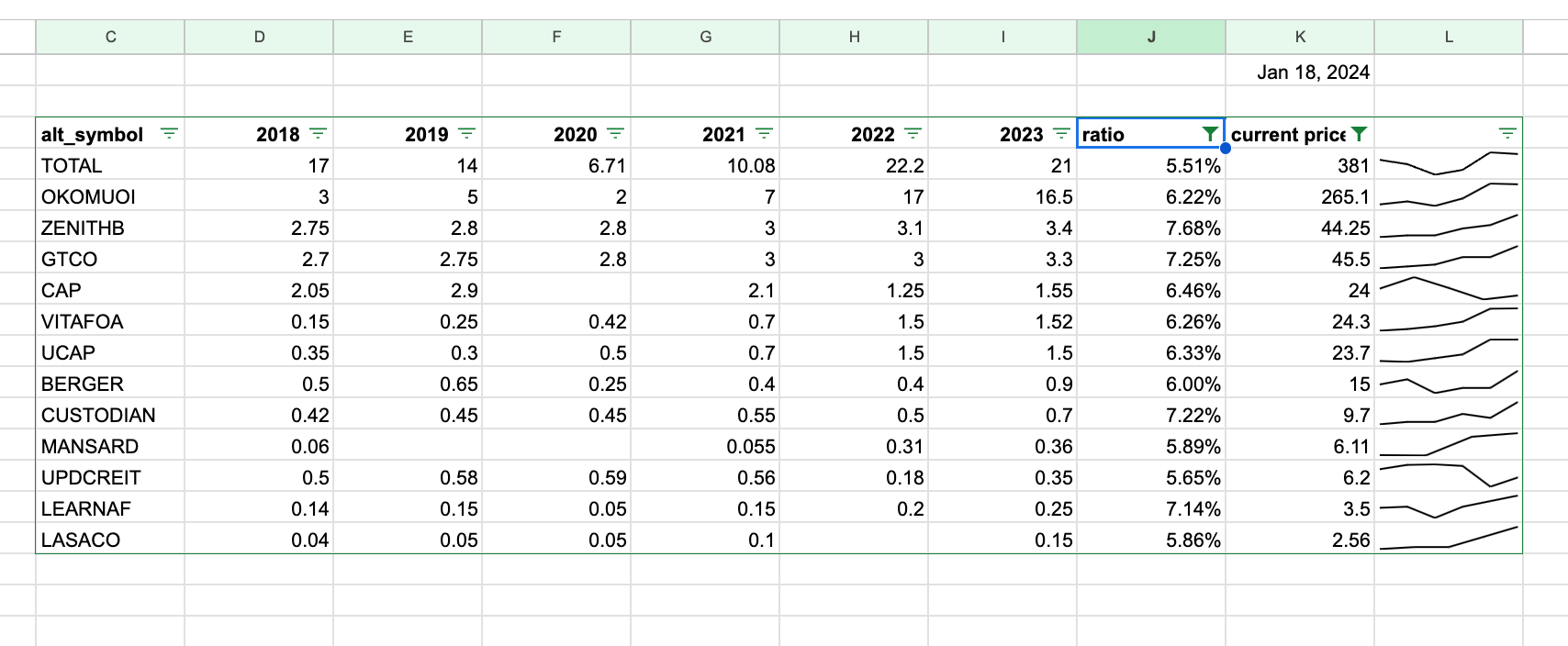

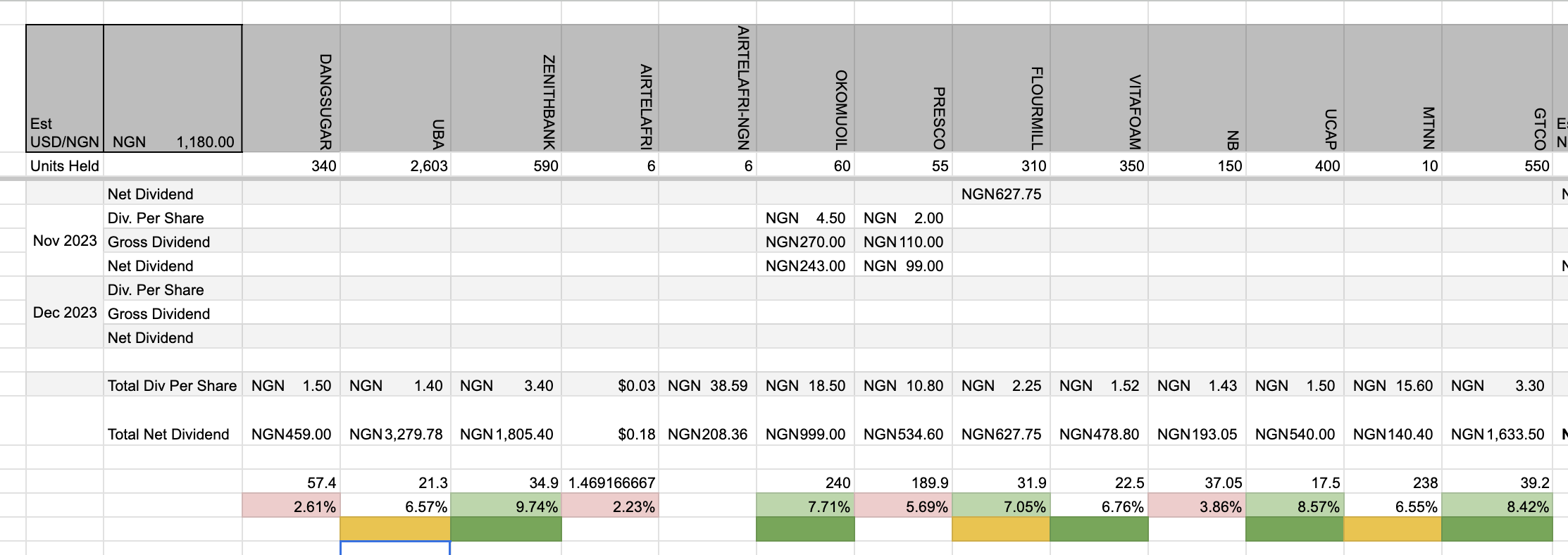

This was the result.

I’ll have to describe the process in a different writing.

The results showed some similarity. I had invested in some of the best performing stocks.

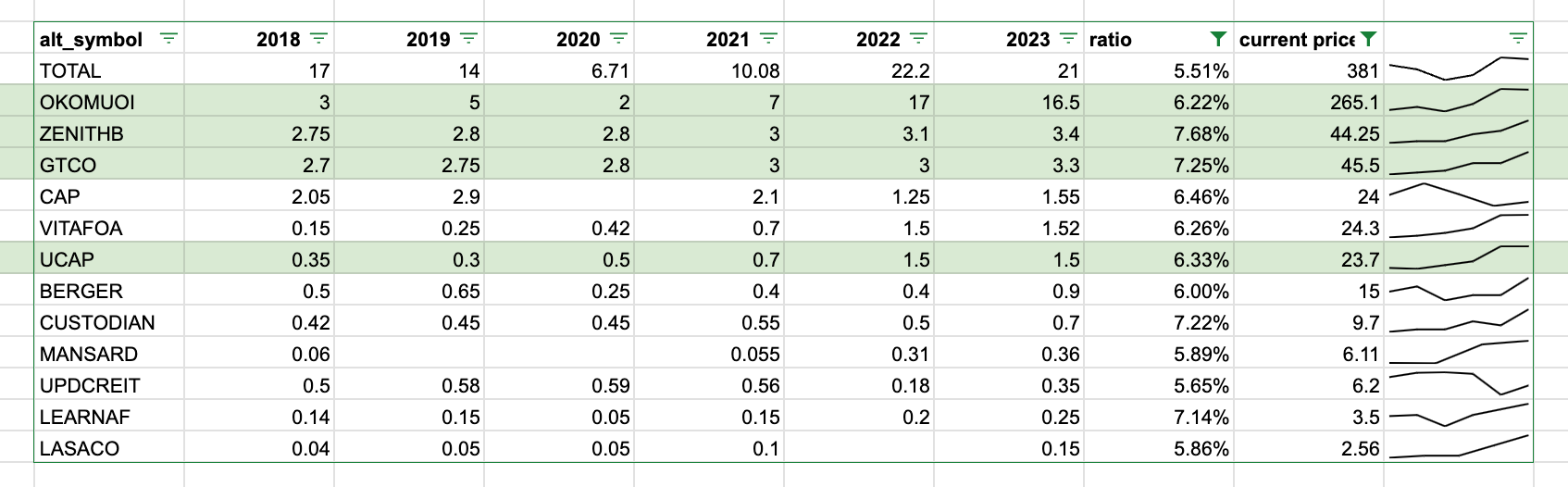

On the other hand, some of the stocks that performed great for me, were not included in this list. I had to do a match-up.

For the first row,

reds: sold

greens: best dividend returns, will not sell, will most likely buy more

not colored: alright returns, but unsure of what to do

For the second row,

when i made the initially investment, i preselected the industry, then selected some stocks based on reputation then made the final selection by manually reviewing 2020 and 2021’s dividend returns

This time (with new skills) i analysed all the stocks and analysed 6 years of dividend returns. that’s the first screenshot.

That analysis showed that some of the highest dividend payers were some of my best performing stocks. they are the ones highlighted in dark green on the second row

The ones in yellow performed well for me, but did not fall within the filter (>5.5% returns)

Now i have to make a decision of which of the yellows to keep and how i’m going to allocate this tranche of investments (new capital + capital from sell-off)

I’ve made a decision.

When I completed the sell-off, I had a total of about 168k (that includes the 100k fresh capital I invested in Nov 2023).

My inclination is to allocate according to the current percentage split. For example, if UBA is currently 30% of my holdings, allocate 30% of the new funds to it.

But that does not consider if UBA had the lowest yield. That’s important.

I am also choosing to ignore a diversification by industry. This is important, very much so in a declining economy. It’s also worthy of note that the success measured in this investment period was not as a result of the dividends earned or the diversification, but the fortunate increase in the economy and hence company/market performance.

This time, I’m blindly making decisions based solely on my calculated/expected dividend yield. Knowing full well, it could lead to substantial losses if the market declines even a little bit (expected dividends cannot offset even a 10% decline).

My stock pick

I’m reinvesting in those that are solid green (second row).

Of the ones in yellow, I’m only picking one: MTNN.

That totals 5 stocks to invest in.

I would have loved to reallocate according to expected increase in stock price but getting that data is a bit tedious (something about a change in Investing.com’s API restrictions)

| Stock | Industry | Expected yield | Previous performance | Previous percentage allocation | Percentage allocation |

|---|---|---|---|---|---|

| ZENITHBANK | Financial Services / Banking | 7.68 | 105.76 | 10.78 | 30 |

| OKOMUOIL | Agriculture / Crop production | 6.22 | 38.25 | 6.43 | 10 |

| VITAFOAM | Consumer goods / Household Durables | 6.26 | 26.01 | 3.73 | 10 |

| UCAP | Financial services / Others | 6.33 | 88.19 | 4.03 | 10 |

| GTCO | Financial services / Banking | 7.25 | 145.28 | 10.52 | 30 |

| MTNN | Technology / Communications | 5.41 | 25.97 | 1.16 | 10 |

So, I’ll go with their previous performance, combined with expected performance. I’ll also factor in my opinion of their expected performance based on news and other information I have consumed but cannot reference at this time.

Action

Wealth NG experienced a technical difficulty at some point during the year and because of this, they couldn’t pay dividends. They sent an email saying the unpaid dividends were deposited directly into our Cash Wallet but I honestly can’t be sure of this. I haven’t done a good job of monitoring the cash balance.

Because of that, I feel the need to diversify, and not put all my eggs in one basket. I’ll withdraw all the funds currently in the cash reserve and deposit into Trove. That’s where I’ll make this round of investment.

To be clear, this is the current look of my portfolio on WealthNG (as at Jan 21 2024, 10:53)

This will close out during the week.

- Withdraw from WealthNG to Trove

- Buy new stocks

I want to hold this stock investment (and the previous one on WealthNG) for two years, that's Jan 2026. I’’m very likely to do another evaluation at the end of a year.

And that’s it for the Nigerian market.

The US Market (continued in a different note, not published yet).